Meet the people behind your next growth move.

We think like entrepreneurs, partner like investors, and execute like operators.

Built by operators.

M&A Operators in Your Region

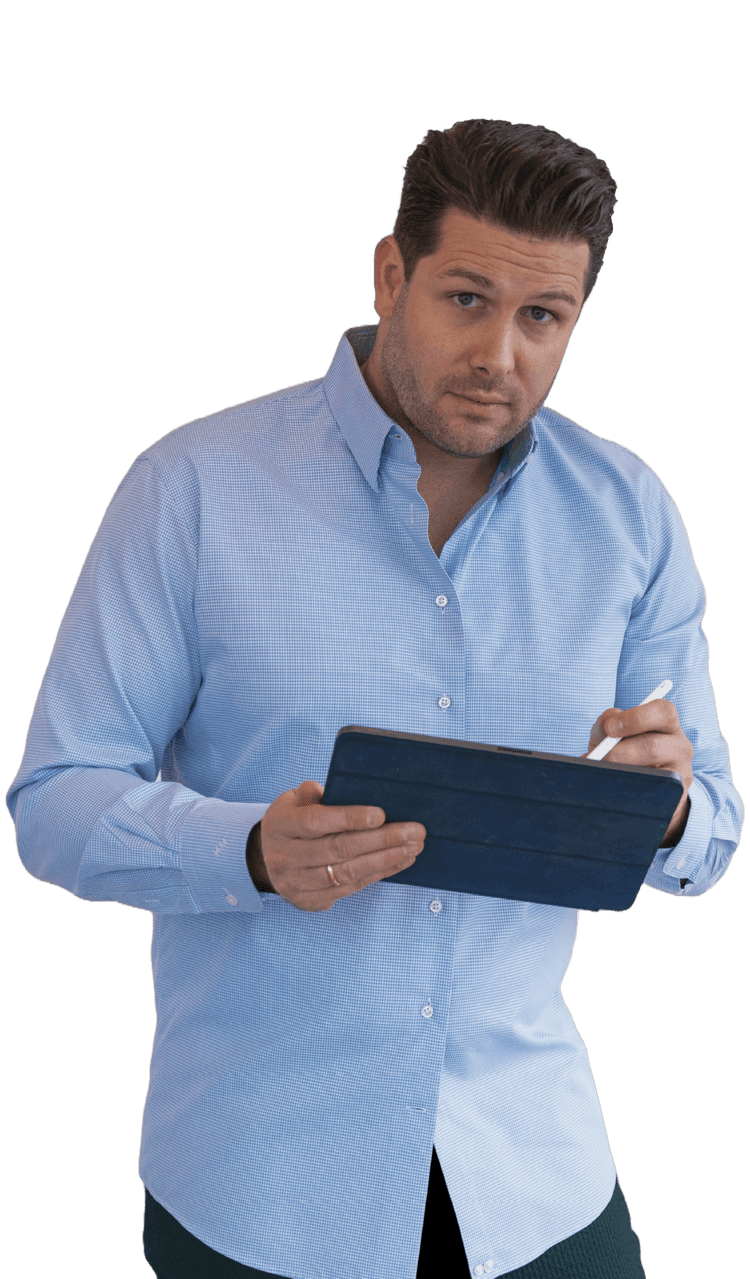

Mark Neuhauser

Mark founded P4i and leads the firm’s DACH and US M&A advisory practice, guiding buy- and sell-side engagements for leading private equity investors, corporates, and entrepreneurs. He has executed more than 60 M&A transactions across IT, software, marketing, and business services.

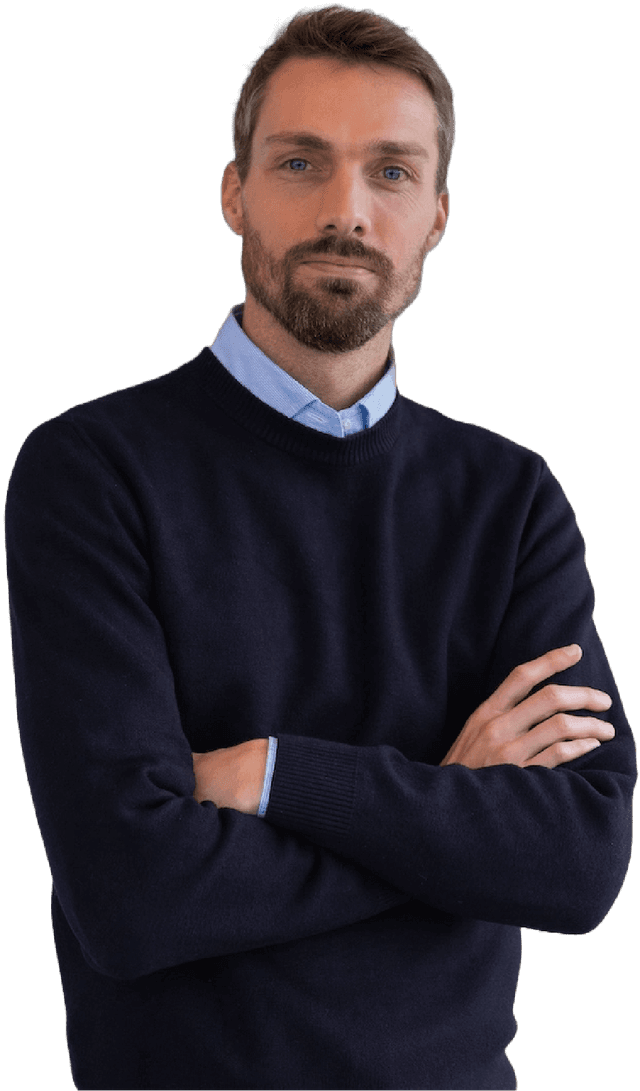

Ron Spicker

Ron leads M&A execution across Spain and Southern Europe, advising on cross-border acquisitions, exit mandates, and international buyer preparation. His expertise spans technology, industrials, and growth-focused SMEs expanding beyond the Iberian market.

Freek Beumer

Freek leads P4i’s Benelux and Nordics operations, advising private equity investors and strategic buyers on pan-European acquisition sourcing and sell-side processes. His expertise covers B2B business models, Industrials and Specialty Materials, as well as mid-market consolidation strategies.

What makes us different

Smarter Deal Origination

We leverage proprietary M&A sourcing technology and curated global networks to uncover off-market opportunities for corporates and private equity investors — faster, smarter, and more precisely.

Global, Local, Seamless

From New York to Zurich and Madrid, our local M&A advisory teams manage complex cross-border transactions end-to-end, ensuring cultural alignment, efficient execution, and frictionless collaboration.

Fluent in PE & Entrepreneur Realities

We combine institutional deal expertise with entrepreneur empathy — structuring transactions that balance financial optimization, growth objectives, and long-term legacy considerations.

Engineered for Momentum

Our lean deal process — from investor-ready materials to competitive buyer management — drives transaction speed and certainty, empowering clients to capture value before the market shifts.

Let’s talk growth.

Who we advise

Private Equity, Corporates & Entrepreneurs Worldwide

Private Equity & Corporates

- Proprietary deal sourcing engine identifying off-market targets across North America and Europe

- Buy-side advisory with global reach and sector-focused origination

- Target screening, validation, and engagement with founder-led businesses

- Acquisition pipeline management for platform investments and add-ons

Entrepreneurs

- Exit readiness and valuation positioning for international buyers

- Sell-side execution including investor materials, buyer outreach, and competitive tension

- Cross-border transaction management between US and European markets

- Post-merger and business preparation support to drive sustainable integration and value creation

In the Media

Experienced leaders expanding our perspective.

Latest Insights From Our M&A Team

10 Key Questions PE Firms Must Ask Before Entering Niche Markets

Head of Iberia

Mastering Post-Merger Integration (PMI): What Corporates Must Know

Head of Benelux